How to Build Unshakeable Financial Security—Even With Unpredictable Income

Your Peace of Mind Shouldn't Depend on Payday 🌱

Hey friends 👋

Last month, two messages landed in my inbox—just hours apart. Different stories, same anxiety.

"I'm a freelance designer—some months it's ₹85k, other times barely ₹20k. How do I find stability on this rollercoaster?" — Rahul

"My company delays salaries for weeks. How do I stay afloat when paychecks are unpredictable?" — Priya

Maybe you’ve been there too—staring at your bank app at 1:00 a.m., hoping that payment has finally hit. The stress? It’s real. I’ve lived it.

But here’s what I’ve learned (the hard way):

💡 Security doesn’t come from steady income—it comes from systems that can absorb the chaos.

And toward the end of this post, I’ll share a free template I built to help you create your own income buffer—even if your paychecks are all over the place. You can plug in your numbers and build your financial safety net in under 10 minutes.

Let’s dive in.

🔑 The Income Shock Absorber Strategy

A financial safety harness for freelancers, salaried professionals, and gig workers.

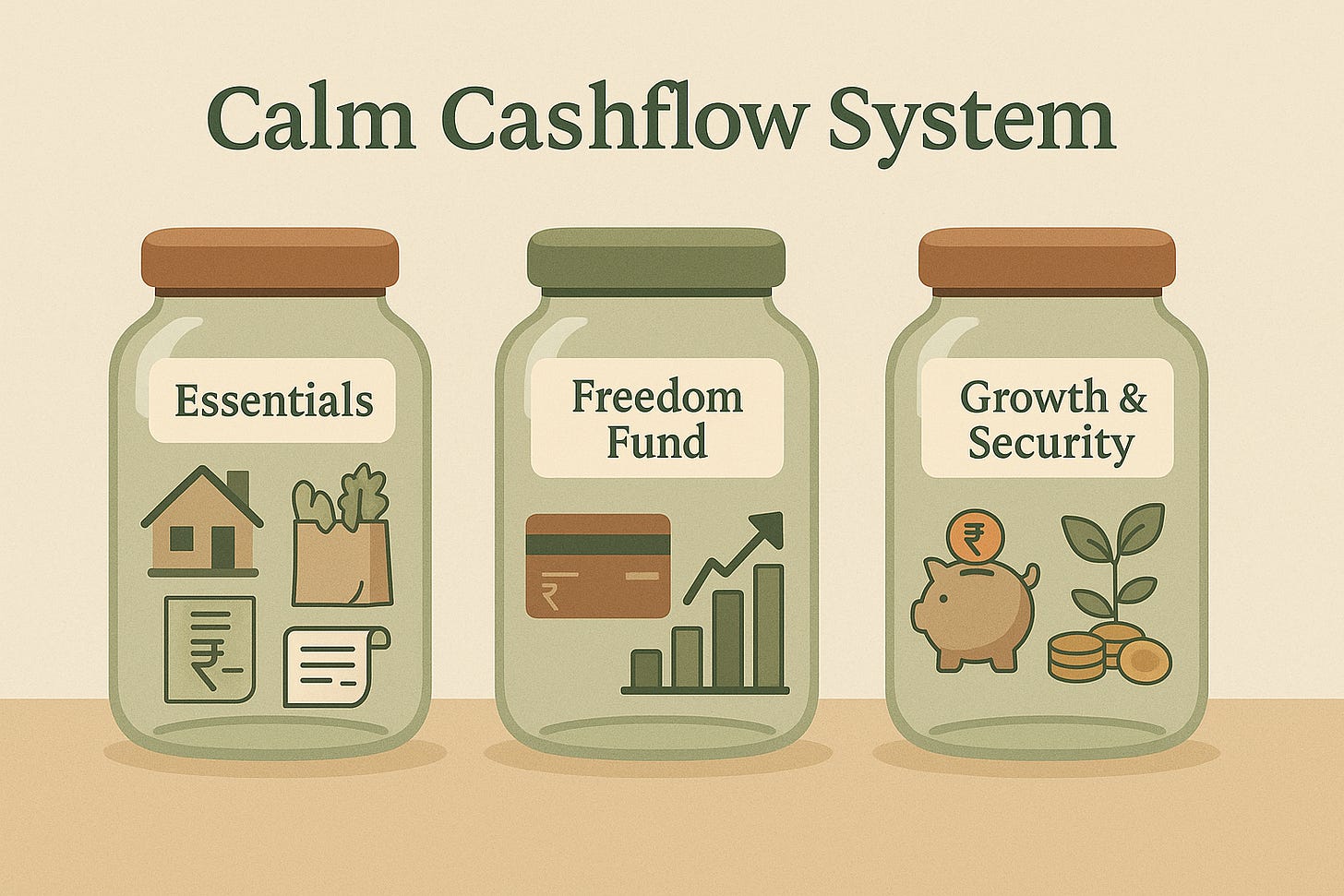

💼 The Calm Cashflow System (Upgraded for Volatility)

(First shared in this post, now evolved for unpredictable income)

“Do not save what is left after spending, but spend what is left after saving.” — Warren Buffett

Split your income into 3 smart buckets:

1. Essentials Bucket (50%)

🏠 Rent | 🍞 Groceries | 💡 Utilities | 📈 Insurance

This is your survival baseline. Prioritize and protect it.

2. Freedom Fund (20–25%)

🚫 Debt Payoff | 📈 Investments (SIPs, Index Funds)

This bucket clears your past and builds your future.

3. Growth & Security Bucket (25–30%)

Layered protection from chaos:

Layer 1: ⚡ Income Shock Absorber (1–2 months of bare-minimum essentials)

Layer 2: 🏥 Emergency Fund (3–6 months of full expenses)

Layer 3: 🚀 Opportunity Fund (career pivots, upskilling, sabbaticals)

🧠 Permission Slip: You don’t need a six-figure income to build this system. You need a six-second habit: split your income every time it lands.

💥 Why Traditional Budgeting Fails

The Circuit Breaker Protocol for Income Chaos

Step 1: First-In-First-Protected Rule

When money lands:

Lock next month’s essentials immediately.

Refill your Shock Absorber before anything else.

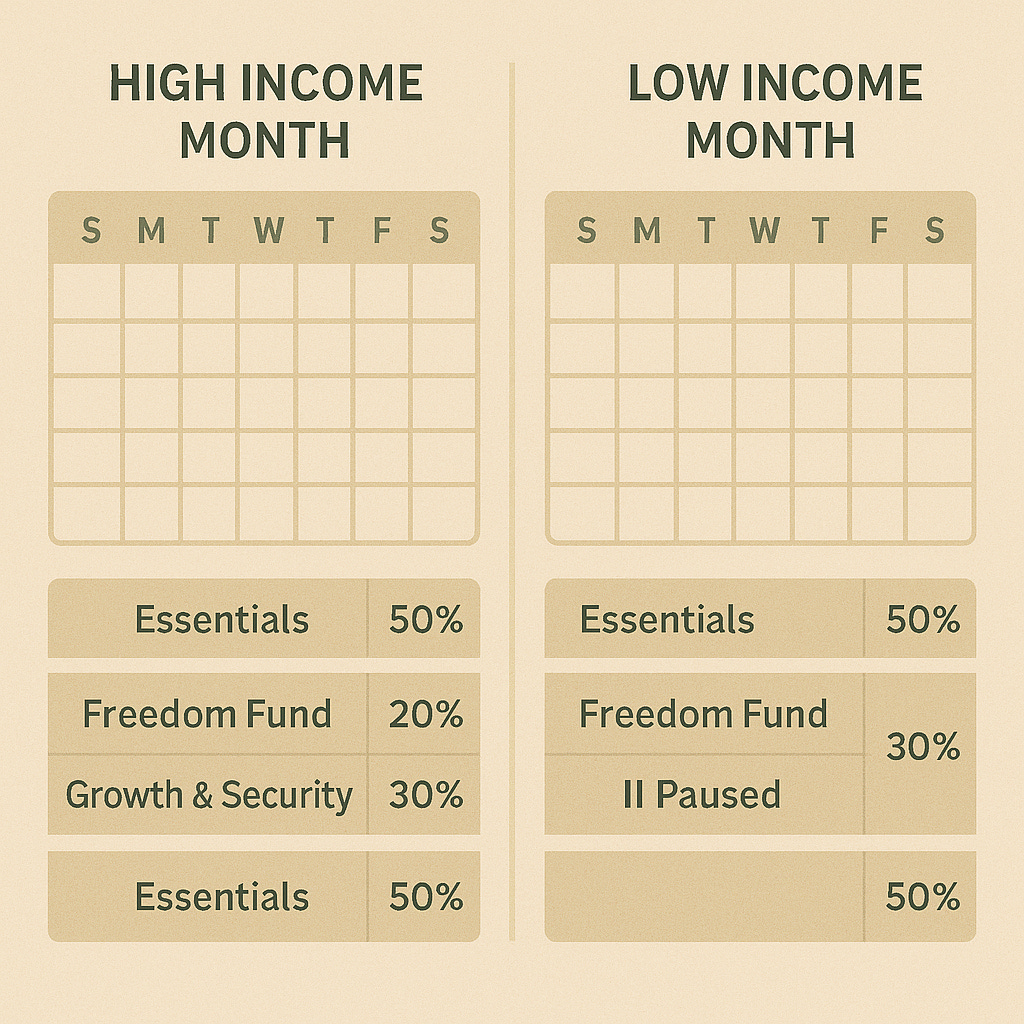

Step 2: Dynamic Allocation

High-income month? Allocate up to 40% to Security.

Low-income month? Temporarily pause Freedom Fund and just cover essentials.

Step 3: Income Disruption Protocol

Phase 1: Shock Absorber → Gives 60 days of breathing room.

Phase 2: Cut non-essentials → Subscriptions, takeout, excess spending.

Phase 3: Renegotiate fixed costs → Lower rent, prepaid plans, defer EMIs.

📈 My 2020 Income Crisis: The Stress Test That Changed Everything

In January 2020, I moved from Bangalore to Chennai—restarting life with new routines, new bills, and zero financial cushion. I'd just finished paying for school admissions and relocation costs.

Then COVID-19 hit in March.

By April, my employer slashed salaries by 30%. The timing couldn’t have been worse.

Phase 1 (Months 1–2)

My Shock Absorber fund became my safety net. Rent, groceries, even Swiggy—handled without debt.

Phase 2 (Month 3)

Trimmed 40% of spending. Cooked all meals, canceled subscriptions.

Phase 3 (Month 4)

Negotiated a rent hike waiver—saved nearly 10% of annual outflow.

📌 Result: I weathered five unstable months without touching my emergency fund. The system didn’t just save me—it empowered me.

"Financial freedom is a mental, emotional, and educational process." — Robert Kiyosaki

🚀 4 Universal Tactics to Supercharge Your Shock Absorber

1. Instant Savings Buffer ⏳

Save 20% of Every Income Chunk

Freelancers: Auto-transfer 20% of payments.

Salaried: Set up auto-debit on payday.

Gig workers: Save 20% of each day’s earnings.

2. Anticipate Cashflow Gaps 🗓️

Pre-Save for Predictable Stress

Freelancers: Save extra before seasonal dips.

Salaried: Plan for big expenses (fees, premiums).

Gig workers: Save during peak earnings.

3. Diversify Income Streams 🥞

Multiple Small Streams > One Big Stream

Freelancers: Add a retainer client.

Salaried: Monetize unused assets.

Everyone: Start small with digital income or dividend funds.

4. Windfall Multiplication Rule

Grow Safety with Unexpected Money

Bonus? Cashback? Festival gift? Allocate 10% to your Shock Absorber.

📲 Your Action Plan (Start in 5 Minutes)

Step 1: Open a Shock Absorber account → Use a separate high-yield savings account.

Step 2: Calculate your Survival Number:

List monthly essentials (e.g. ₹15k rent + ₹5k groceries + ₹3k utilities = ₹23k)

Step 3: Automate 20% of income to this account.

✅ Ready to Build Your Own Shock Absorber?

If this guide resonated with you, don’t just nod and scroll on—take the first step toward building your buffer.

🎁 Grab the free “Income Disruption Survival Plan” template

It’s a plug-and-play Google Sheet (with a PDF Guide) designed to help you:

Calculate your Survival Number

Set up your Calm Cashflow system

Track income swings and build stability over time

👉 Get the free template here (Google Drive link)

(No sign-up. No fluff. Just clarity.)

This is your next step toward calm, consistent cashflow—no matter what your paycheck looks like.

🧬 FAQs

Q: What if I can't save 20%?

A: Start with 5%. Consistency > Perfection.

Q: Can I invest my emergency fund?

A: No. Keep it liquid (bank savings or liquid mutual funds).

Q: How do I rebuild my Shock Absorber if I already used it?

A: Allocate 30% of incoming cash to rebuild it first.

✨ 5 Pillars of Income-Proof Financial Security

Know Your Survival Number

Automate Protection First

Renegotiate Before You Cut

Diversify Your Income

Celebrate Small Wins

"The art is not in making money, but in keeping it." — Nirmala Sitharaman

To your unshakeable foundation,

Arun Kumar Boyidapu

Creator of Coffee & Cashflows

P.S. Need a custom plan? DM @CoffeeCashflows or reply to this email.

P.P.S. If this helped, forward it to one friend who needs financial clarity today.

#PersonalFinance #FreelancerTips #EmergencyFund #BudgetingIndia #IncomeStability #MoneyMindset #CoffeeAndCashflows #FinancialSecurity #CalmCashflow #SurvivalPlanning